Do you want financial peace of mind?

Hey, We are Marlene and Thuy. We want to help create financial freedom for as many people as possible. Our question is, will YOU be one of them?

Money blocks are real. And most of us have experienced them in one form or another. It wasn’t until 2017 when we realized that we had money blocks ourselves. Yes – as money and financial experts, we also deal with money blocks!

As we reflected on our careers in the financial industry, one thing became clear to us. We were not happy with the income that we were making, taking into consideration the amount time that we had invested. On top of this, we felt that we didn’t fit into their culture or compensations models based on our values.

Our solution to this was to open our own business, to have full control over the way we wanted to do business and the compensation model that aligned with our values. We decided to offer Fee-Only Financial Consultation. And we would only provide product solutions if the ones we had access to in our brokerage was suitable for the client.

But guess what?? We found ourselves right back where we started. Once again, at a point of discontentment and complaining about heavy administration, non-sense compliance, money-grab CE credits, and market fluctuations that were out of our hands. We were ready to give up on the financial industry.

As you’ve noticed, we were constantly shifting our way of doing things. Finally, we took the time to reflect on our priorities and what mattered to us. It now became clear to us that we had chosen careers based on our skillset and the money-making potential. Through this, we discovered that one of our money blocks is ‘you can’t make money doing what you love’.

What is a money block?

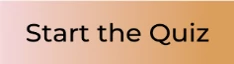

Money blocks are the result of our money beliefs the money stories we tell ourselves. Money blocks can sabotage our financial success, including our debt paydown, savings and investing goals. It can hold us back from reaching our income potential, building wealth, and establishing a healthy relationship with money.

So, how do we end up having money blocks? We pick up most of our money beliefs from our families, friends, and the society we live in, without even realizing it.

If your ever heard your parents say, ‘money doesn’t grow on trees’ or ‘we don’t have enough money’, or ‘we can’t afford it’, these are money stories that you’ve likely adopted. The belief that money is scarce and ‘that there is never enough’ is quite common. When we have this belief, over time, these thoughts and “beliefs” become “facts”. And this in turn, creates money blocks.

6 Steps to Break Free from Your Money Blocks.

- Start with recognizing all the money stories and habits you might have absorbed throughout your life.

- It can help to start with your past: go as far back as your childhood. Did your parents talk about money? How were their conversations about money with one another? When you asked them for things, what was the answer? When they decided to pay for things, did they ask for anything in return? How did they talk about money with you?

- Did you have any serious or traumatizing experiences as a child (not just financial) that might have a lasting impact on your finances?

- Now, start to explore your money interactions as an adult. Ask yourself these same questions.

- Be present to any money stories that show up or any patterns.

- Start a journal to write down your findings.

- What kinds of words do you use when you talk about money? And how do you talk about yourself in relation to money?

- Start to pay attention to this and you’ll begin to uncover a lot of your money blocks.

- Identify your money blocks and underlying stories and beliefs.

- Identify the areas in your life that have been affected by your money blocks – relationships, career, financial success.

- Get in tune with your feelings towards money and note where you are blaming yourself or others.

- Take responsibility and practice forgiveness.

- Disprove your story. Identify at least one money story you’ve been telling yourself. And find evidence, experience or facts that dispel your current money story.

- Disassociate your self-worth with your net worth.

- Money stories are not written in stone. Choose a new story and act on it.

- Commit to change.

- Cultivate an abundance mindset. Choose a practice that resonates with you. It can be meditation, affirmations, EFT, NLP, visualization, etc.

- Empower yourself with knowledge about money and finances.

- Anytime you’re feeling a lack around money, give some away. Donate to a cause you believe in or treat your friends or family to coffee.

- This doesn’t have to be a huge amount. The point is just to adjust your thinking from scarcity to abundance. When you’re generous, you’re reinforcing the truth that there’s plenty to go around. There’s always more where that came from.

- Books and podcasts

- Surround yourself with others with an abundance mindset

- Hire a money mentor or work with an accountability partner

You can beat your money blocks and have sufficient money

So, yes, dealing with our money blocks is an ongoing process.

We also want you to understand that you are not alone. You can break free from your money blocks. And with time, you will get better and better.

One of the things that helped us to understand our money stories was uncovering our money personalities.

Reading this blog is a great starting place to start, however that is not where it should end. We want to be by your side in your journey.

We are offering access to our free money mask quiz for you to understand your money personality. Use the link below to get free access to the quiz.

In the comments below, let us know if you’ve uncovered money blocks that you were not aware of.

With love and gratitude,

Marlene and Thuy

Do you want more

Money + more Time?

Marlene & Thuy

Marlene and Thuy have spent over 20 years in the financial industry helping individuals with their investment, insurances, lending needs and are former Financial Planner. Since then, they’ve discovered the missing link to money freedom because as they said: “Making more money and being financially savvy won’t necessarily give you the life you want – because money goes deeper than the numbers.” When you work with Marlene and Thuy, they will guide you through the deeper inner work to remove what is keeping you from having the life that they want.