Hey! We are Marlene and Thuy. We want to bring financial clarity for as many people as possible. Our question is, will YOU be one of them?

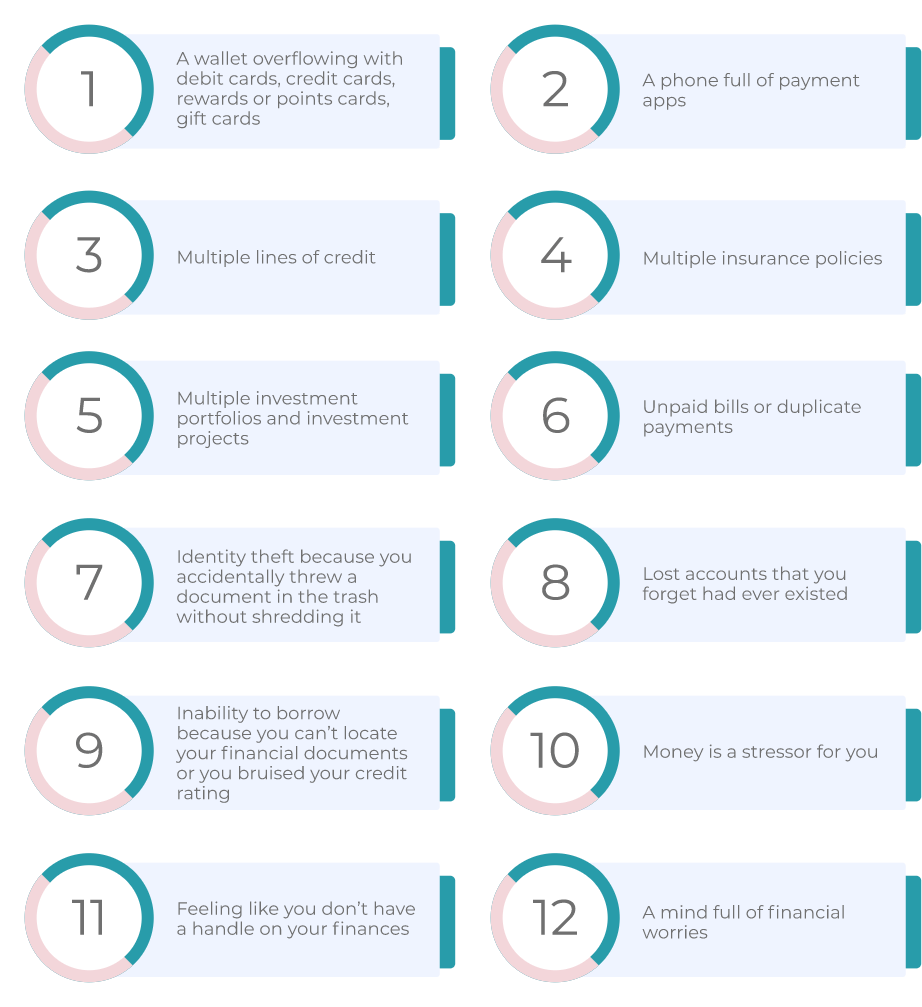

Do you often feel like you do not have a handle on your finances? Or feeling overwhelmed by multiple bills and credit card payments? Not finding the time to review all your bank account statements or your insurance before renewal? And what about sitting down to assess the performance of your investments or locating all your tax slips and expenses for tax filing? Have you missed a bill payment, got charged NSF, or misplaced your financial documents? You are not alone. Nearly One in four Americans has either lost or forgotten about a vital financial document, and only 40 percent think they could find a key document at a moment’s notice, according to a poll by the Consumer Reports National Research Center. In our past career as financial planners, the term ‘financial clutter’ didn’t exist. Keeping our financial affairs in order was about having a filing system for our financial documents.

Our filing cabinet started to overflow with financial documents, and we ran out of space..

We noticed rustration every time we had to invest time in organizing or locating documents. We started to hear ourselves and each other complain about the multiple phone calls we had to make to fix servicing issues. And never mind having to shop for a bigger wallet to fit all of our debit, credit cards, points cards!

This is the moment when the light came on and we realized that we had financial clutter. And it was robbing us of our time, energy and money.

Financial clutter is not easy to spot or identify because it’s not always visible. It’s when you have an excess of financial products, financial solutions and financial instruments. You know if it is financial clutter because it feels unfinished, unresolved, messy and complicated, or it’s something you’ve been avoiding!

We tend to blame ourselves or others when we lose control of our finances or when we’re not happy with where we are financially. We fail to recognize that one of the biggest offenders of this is having financial clutter.

Financial clutter can block our progress towards our financial goals, and the cost can be huge. The following are just a few ways clutter costs us extra money, time and stress:

1. Overpaying for the cost of borrowing money

2. Debt piling up

3. Underperforming investments

4. Overpaying for your insurances coverage

5. Paying more in fees than you need to be

6. Not having any money left after paying all the bills

7. Extra expenses

1. Not knowing where your money is going

2. Bruised credit score

3. Shuffling money around to pay all of your bills

4. Off track to meet your financial goals

5. Wasting your time managing your multiple financial solutions

1. Causing friction and arguments with your partner about money

2. Losing sleep over your money worries

3. Feeling overwhelmed about your financial future

4. Living in fear of of not having enough money

So, having in mind the cost of financial clutter, we challenge you to approach your clutter head-on. Don’t wait until you feel overwhelmed to get a handle on your clutter. Here are some easy steps on getting rid of your financial clutter. Keep in mind that it’s a process. Take one step at a time, and you’ll reap the rewards!

1. Book time in your calendar to get started.

2. Make a list of all of your financial products, including the ones offered by your employer. Document where and how to access them.

3. Remove multiple financial apps that are in fact overcomplicating your finances. Pick one or two that bring you the most value.

4. Review the steps below and jot down the ones you can do on your own and the ones where you will need help.

1. Gather all your financial documents and decide which ones to keep and for what time frame. Shred the rest.

2. Sign up for paperless statements and billing; save as electronic files.

3. Determine which documents you need to file as a hard copy; otherwise scan and electronically file the rest.

4. Book time in your calendar to review all documents to keep them up to date based on your current circumstances.

5. Stay organised by keeping the current year’s records handy and archiving the rest. Make note of when you can shred or delete your archived files.

1. Simplify and consolidate your banking by cutting down the number of accounts to just one daily banking and one or two savings accounts.

2. Choose one or two primary methods of payment. Set up automatic bill payments; for manual bill payments, schedule in your calendar.

3. Avoid or reduce rewards or points cards.

4. Set time aside to audit all your automated payments, memberships and subscriptions. Cancel the ones you are no longer using.

1. Choose a couple of credit cards to continue to use. Look for lowest interest; avoid annual fees unless it is worth it; otherwise choose cash back.

2. Avoid store credit cards, which frequently have low credit limits and high interest rates — both potential hazards for your credit score.

3. Review your line of credits and choose the ones with lowest interest rates and close the rest.

4. Set up an automatic debt payment plan.

5. Consider consolidating debt to reduce interest cost.

6. Review your credit report for overall score and to ensure up to date information. Take immediate action on any discrepancies.

1. Set a goal in terms of your expected rate of return on your investments.

2. Review your investments with an eye for – fees, return on your investment, and risk-reward benefit.

3. Assess the amount of time it takes for you to manage your investments. Consider the benefits of having a consolidated investment strategy that will save you time.

4. Automate your ongoing investment contributions.

5. Choose WHO will be managing your investments and making the investment decisions.

6. Narrow your advice circle to trusted professionals who have credentials and a proven record. Don’t take investment advice from influencers or friends and family who do not know your circumstances.

1. At yearly insurance renewals, for any premium increases and if existing coverage is up to date given your current circumstances.

2. Compare your group coverage with your personal coverage with an eye for overlapping coverage.

3. Review your insurance contracts and assess if you have the right amount of coverage, what you are really covered for, and the cost.

4. Cancel or reduce the amount of coverage if you find that you are over- insured or self-insured.

Discuss openly your roles and responsibilities when it comes to money and finances. Do you want to be an income earner? Do you want to be a stay-at-home? Do you want to manage the family finances (paying the bills, establishing a budget, making the investment decisions, filing taxes)? Do you want to be the one teaching your kids about money?

Decluttering your finances will not happen overnight. Start small. Set aside time and put it in your calendar. Have an accountability partner. Decide if you have the knowledge, skills and interest to do it all on your own. Otherwise, hire an expert to work with you.

Once your financial clutter is gone, you will feel more in control of your finances and have a sense of calmness.

Get ready for your bank account to grow!

Marlene and Thuy have spent over 20 years in the financial industry helping individuals with their investment, insurances, lending needs and are former Financial Planner. Since then, they’ve discovered the missing link to money freedom because as they said: “Making more money and being financially savvy won’t necessarily give you the life you want – because money goes deeper than the numbers.” When you work with Marlene and Thuy, they will guide you through the deeper inner work to remove what is keeping you from having the life that they want.

Marlene and Thuy’s best money tips, straight to your inbox.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |