Hey, we are Marlene and Thuy. We want to create money harmony for as couples and families as possible. Our question is, will YOU be one of them?

Money can be a really difficult topic to talk about, and especially with our partners. We often steer clear of conversations about money so that we can avoid the difficult emotions these conversations bring up. And even if we wanted to open the dialogue, we were never taught how to talk about money. When thinking back to the days when we first met our spouses, the only conversations we had about money were very elemental. We talked about opening a joint bank account to save for our wedding and to join our financial affairs. And we were open and transparent about our own financial circumstances. Somehow by luck, we entered into relationships where we are compatible and pretty much on the same page with our spouses when it comes to money. Also by luck, we did not experience life events that brought out the worst case scenario when there is no open dialogue about money..

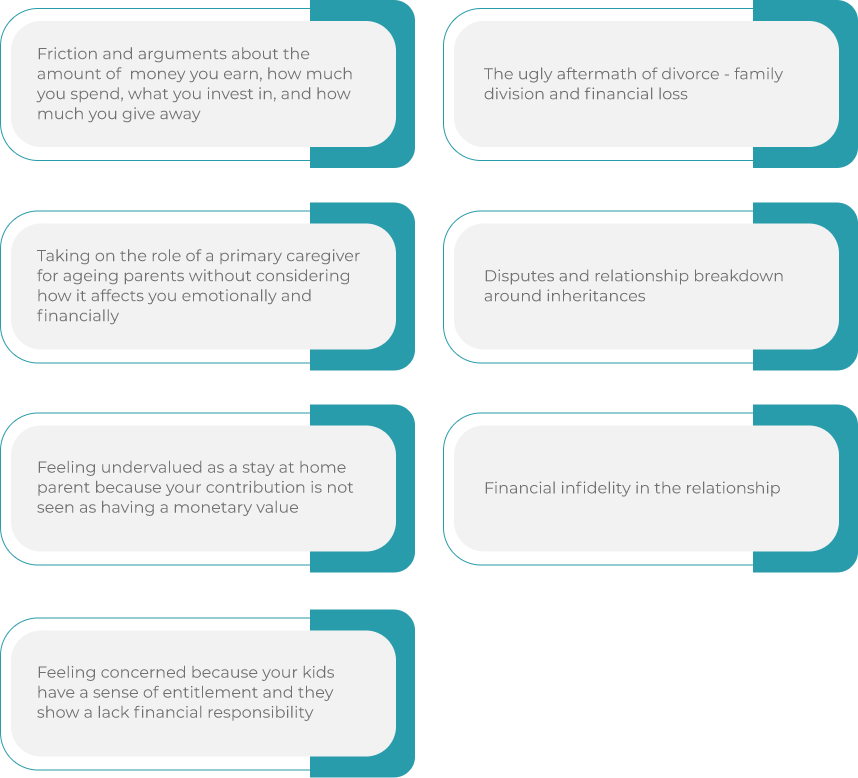

Through our personal growth journey, it became clear to us that we were not having open money conversations with our spouses. Our conversations about money were limited. We focussed more on how much money our spouse was making, since making money was important to us. So when it came time to talk about money with our spouse’s, we felt the immediate energy shift and friction. Any conversation about money stopped dead in its tracks. And think about it. We are both former CFPs with 20+ years of experience in the financial industry. Yet we didn’t even know how to converse openly about money. And we knew we weren’t alone. In our years of serving hundreds of families, we noticed what happens to relationships and finances when people do not have open money conversations.

When it comes to money, open communication is key. But how many of us actually know how to even start this dialogue, and what it looks like?

Ask and listen with compassion, and without judgement. Start by asking yourself the following questions, and then asking your partner to do the same. Once you have your answers, have a conversation and share with the intent to listen and understand each other’s perspective. Then discuss the areas where you are on the same page, the areas where you are ready to work together, and the areas where you will need to set boundaries and accept your differences.

Start by understanding how you relate to money. How were your experiences with money as a child? Did your parents argue about not having enough money to pay the bills? Did you witness your parents having to sell the house because they lost their job? Or did you have other experiences with money that stands out?

Your money habits are primarily built to protect you from experiencing past pain. What are some of the money habits you may have formed as an adult, as a result of your experience with money as a child? If your parents argued about not having enough money to pay the bills, it makes sense that your childhood brain went, “I’d better make lots of money when I grow up, so I can pay my bills easily and avoid fights about not having enough.” As an adult, this might drive you to work overtime or search for new side hustles as additional income streams. If your parents lost the house, your childhood brain might go, “I should save as much money as I can, to make sure that I will never lose my house”. As an adult, this might look like putting your dreams on hold because you are so focussed on saving money. And you keep your money in high-yield savings accounts or guaranteed investments to have a sense of security.

Start by understanding how you relate to money. How were your experiences with money as a child? Did your parents argue about not having enough money to pay the bills? When you start to think or talk about money, be present to the way you are feeling. Everyone’s emotional responses to money are different, so the way you react to a certain situation might be completely different to how your partner feels in the same situation.

How do you feel when your bank account is running low? How do you feel when you or your spouse racks up the ongoing balance on your credit cards? Embarrassed or worried? How do you feel when you make a big purchase for yourself? Guilt, shame or joy? How do you feel when it’s time to review your finances? Avoidance, anxiety or empowered?

Consider putting everything on the table for discussion. What is your income level? What debts do you have? How much money have you saved? How do you want to combine your finances? What do you consider as joint family savings and debts, and what do you consider as separate? What do you consider as joint family spending? And what do you consider as separate personal spending? Or do you combine everything?

Let’s talk about the ‘what-if’ scenarios to understand each other’s point of view should these scenarios play out. What happens when I die, what happens if I die prematurely, what if we decide to end the relationship, what if I get sick and can no longer, what if I lose my independence or what if I get a large inheritance? How will we handle the financial side of things in all of these situations?

Discuss openly your roles and responsibilities when it comes to money and finances. Do you want to be an income earner? Do you want to be a stay-at-home? Do you want to manage the family finances (paying the bills, establishing a budget, making the investment decisions, filing taxes)? Do you want to be the one teaching your kids about money?

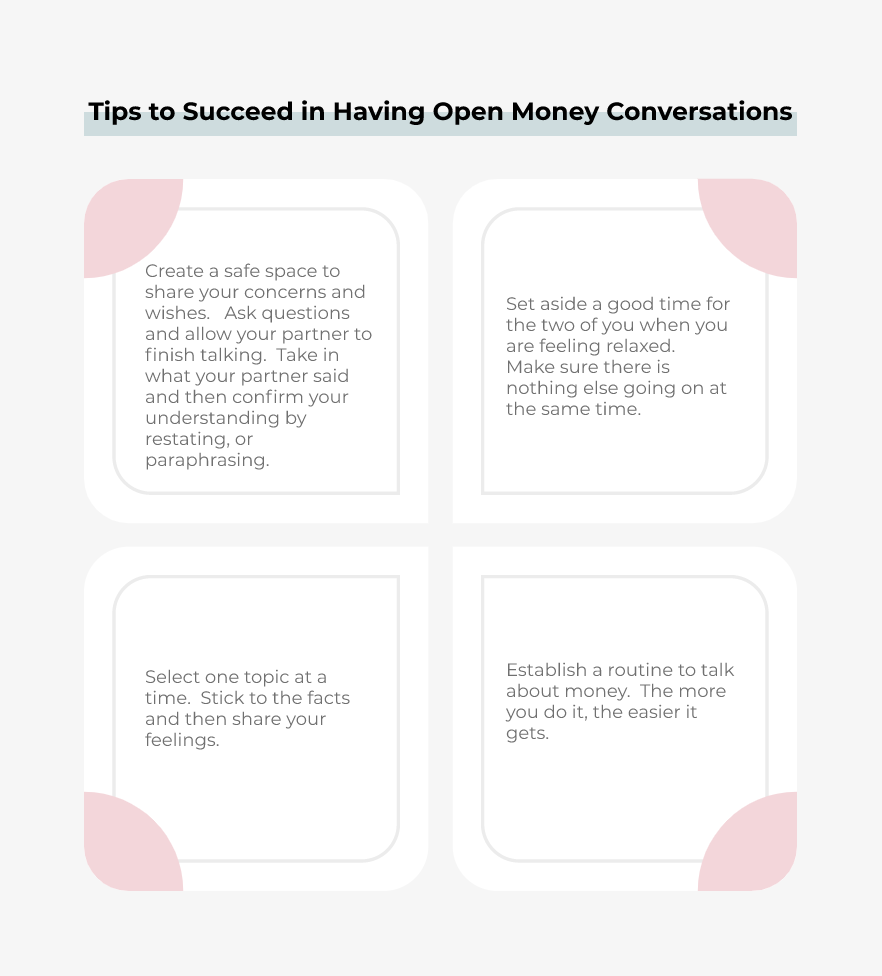

Here we’ve shared some guidance on what areas to cover when having open money conversations. This kind of conversation will be hard at first and may not always achieve the results you hope for. That’s OK, the point is to start talking, whatever that looks like.

We would love to know – how confident do you feel about starting these open money conversations?

And how are your money conversations coming along? We know this money thing isn’t easy, so let us know how we can support you!

Marlene and Thuy have spent over 20 years in the financial industry helping individuals with their investment, insurances, lending needs and are former Financial Planner. Since then, they’ve discovered the missing link to money freedom because as they said: “Making more money and being financially savvy won’t necessarily give you the life you want – because money goes deeper than the numbers.” When you work with Marlene and Thuy, they will guide you through the deeper inner work to remove what is keeping you from having the life that they want.

Marlene and Thuy’s best money tips, straight to your inbox.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |